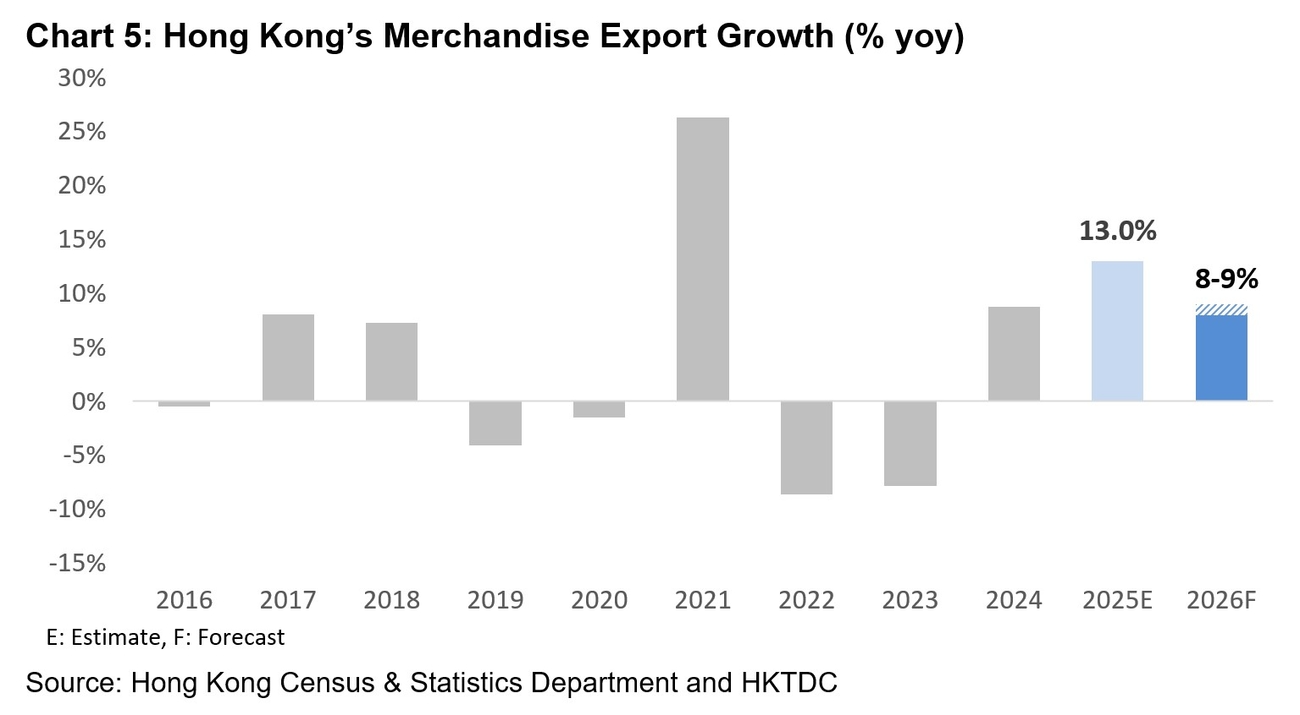

Hong Kong 2026 Export Outlook: Sustained AI Product Demand Set to Drive 8-9% Growth Over Coming Year

In 2026, the outlook for Hong Kong’s merchandise exports is expected to remain positive. This should see strong growth of 8‑9%, underpinned by robust demand for AI‑related electronics products. This will be despite the legacy of a high base from early 2025’s spike in frontloaded shipments, a practice adopted in anticipation of the widely expected US tariffs.

For now, at least, it appears that the uncertainties associated with the US tariffs have eased, an outcome reflected in the findings of the recently‑released HKTDC 4Q25 Export Confidence Index. This largely stems from Chinese Mainland and the US reaching a trade agreement in early November, while multiple other countries came to their own accommodation with the Trump administration as of August. As a result – and perhaps surprisingly – US tariffs do not feature on the list of Hong Kong exporters’ three primary 2026 concerns.

For 2026, one consequence of the tariff regime will be global business leaders developing longer‑term strategies in order to optimise their US and non‑US business portfolios. This will be, at least partly, in response to the differential tariff rates that have given some countries comparative advantages when exporting to the US.

In the case of Chinese Mainland exports to the US, these will be subject to a 20% tariff rate1 (10% reciprocal tariff + 10% fentanyl related) for the period 10 November 2025 to 10 November 2026. This comparatively low tariff level puts China‑based suppliers with more mature and higher productive supply chains on a par with many of their Southeast Asia counterparts, while providing them with a significant competitive advantage over countries with a higher tariff rate.

A better-than-expected export performance in 2025

Putting the past year in perspective, Hong Kong’s exports grew by 13.8% year‑on‑year (yoy hereafter) in the first 10 months, a performance that exceeded HKTDC Research’s earlier forecast of 7‑9% for 2025 overall. In addition to the previously‑cited front‑loaded shipments, this unexpectedly robust performance was down to sustained demand for AI‑enabled electronic devices (especially computer equipment and related items) (See Table 1). Beyond that, exports in the Toys and Games sector enjoyed a significant rebound, rising by 33.2% yoy, following their 2024 plunge of 21.8%. We estimate that Hong Kong’s total export will have grown by about 13% for 2025 as a whole.

Table 1: Hong Kong’s Exports by Key Sector

2024 | 2025 Jan-Oct | |||

HK$ mn | YoY Change | HK$ mn | YoY Change | |

Electronics | 3,307,138 | 12.5% | 3,178,662 | 17.3% |

- Parts & Components | 2,518,082 | 11.3% | 2,440,647 | 18.8% |

- Finished Products | 789,056 | 16.4% | 738,016 | 12.6% |

Fine Jewellery | 80,500 | -8.3% | 68,852 | 1.2% |

Timepieces | 48,790 | -10.5% | 40,739 | -0.3% |

Clothing | 49,298 | -3.7% | 35,767 | -12.3% |

Toys & Games | 13,685 | -21.8% | 15,028 | 33.2% |

Total | 4,542,371 | 8.7% | 4,260,191 | 13.8% |

Source: Hong Kong Census & Statistics Department and HKTDC | ||||

Mixed performance across major export markets

Reviewing the performance of the city’s key export markets sees a decidedly mixed picture emerge (see Table 2). In specific terms, exports to Hong Kong’s two largest markets – the Chinese Mainland (up 15.8%) and the ASEAN bloc (up 31.6%) – both recorded double‑digit growth yoy in the 10‑months to October. At the same time, with the exception of South Korea, exports were up in the case of the city’s other key Asian markets. Over the same period, exports to the US moderately increased by 3.1% yoy, while exports to the EU fell by 2.9% yoy.

Table 2: Hong Kong’s Exports by Key Market

2024 | 2025 Jan-Oct | |||

HK$ mn | YoY Change | HK$ mn | YoY Change | |

US | 295,571 | 8.5% | 258,032 | 3.1% |

EU | 275,674 | 0.7% | 224,476 | -2.9% |

Chinese Mainland | 2,681,658 | 15.6% | 2,540,846 | 15.8% |

ASEAN | 393,449 | 18.7% | 421,514 | 31.6% |

Taiwan | 140,415 | 1.1% | 161,580 | 40.0% |

India | 137,022 | -18.0% | 121,261 | 6.1% |

Japan | 80,656 | -4.4% | 77,179 | 14.1% |

Korea | 68,816 | -6.6% | 51,239 | -11.0% |

Middle East | 129,250 | -5.3% | 103,316 | -4.6% |

Latin America | 82,957 | 11.9% | 77,342 | 11.1% |

Total | 4,542,371 | 8.7% | 4,260,191 | 13.8% |

Source: Hong Kong Census & Statistics Department and HKTDC | ||||

2026: A broadly positive export outlook

US tariffs: Full impact to be felt in 2026

For 2026 overall, global trade growth is expected to slow notably as the full impact of US tariffs gradually emerges. In anticipation of this, the World Trade Organisation (WTO) cut its world merchandise trade forecast for 2026 as part of its October 2025 update2.

This saw its expectation of the growth in world merchandise trade volume downgraded from 2.5% to just 0.5%, largely on account of its substantial downward revision of likely import demand from the US, the world’s largest importer (See Table 3). Justifying its revised forecast, the WTO ascribed the change to concerns that the impact of the US tariff increases on global trade has been delayed on account of the frontloading of purchases that had preceded the tariff impositions.

Table 3: WTO’s Latest Projections of Merchandise Trade Volume Growth

Apr 25 | Oct 25 |

| |||||

Original Forecast (a) | Adjusted Forecast (b) | Difference (b)-(a) | |||||

2024 | 2025 | 2026 | 2025 | 2026 | 2025 | 2026 | |

World Trade | 2.8% | -0.2% | 2.5% | 2.4% | 0.5% | 2.6% | -2.1% |

Exports |

| ||||||

North America | 2.3% | -12.6% | -1.2% | -3.1% | -1.0% | 9.5% | 0.2% |

South America | 6.2% | 0.6% | 0.9% | 2.4% | -1.9% | 1.8% | -2.9% |

Europe | -1.7% | 1.0% | 2.5% | 0.7% | 2.0% | -0.3% | -0.5% |

CIS | 2.3% | 4.4% | 0.1% | -0.7% | 3.5% | -5.1% | 3.5% |

Africa | 1.3% | 0.6% | 1.7% | 5.3% | 0.0% | 4.7% | -1.7% |

Middle East | 3.7% | 5.3% | 5.1% | 2.0% | -0.9% | -3.3% | -6.0% |

Asia | 8.0% | 1.6% | 3.5% | 5.3% | 0.0% | 3.7% | -3.4% |

Imports |

| ||||||

North America | 4.7% | -9.6% | -0.8% | -4.9% | -5.8% | 4.7% | -5.0% |

South America | 6.0% | 5.0% | 0.5% | 8.8% | -0.6% | 3.8% | -1.1% |

Europe | -2.3% | 1.9% | 2.7% | 2.4% | 0.8% | 0.6% | -1.9% |

CIS | 4.8% | 0.5% | 2.1% | 2.7% | 2.6% | 2.2% | 0.5% |

Africa | 2.6% | 6.5% | 5.3% | 11.8% | 5.4% | 5.4% | 0.1% |

Middle East | 11.8% | 6.3% | 6.7% | 3.7% | 1.8% | -2.6% | -5.0% |

Asia | 5.1% | 1.6% | 3.8% | 5.7% | 2.7% | 4.1% | -1.1% |

Source: WTO | |||||||

US trade protectionism measures: Key downside risks

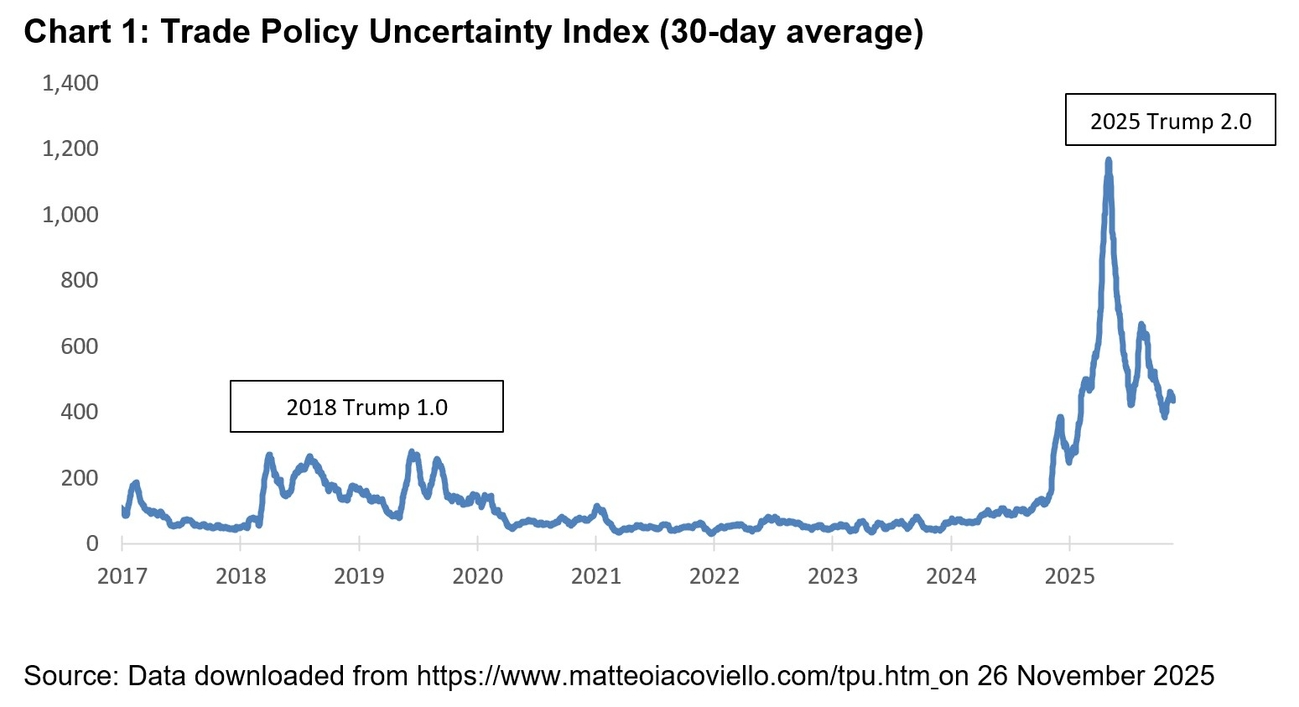

Although there is now greater clarity with regard to the global trade landscape than in early 2025, the US trade measure‑related uncertainties remain high. Indeed, such concerns are evident from Trade Policy Uncertainty (TPU) Index 3, a metric that, while having dropped substantially since its unprecedented highs back in early‑2025, remains well above its typical level (see Chart 1).

While the US’s reciprocal (country‑specific) tariffs have been settled (with the new tariff rates going into effect in August and, in the case of the Chinese Mainland, November), the Trump administration’s Section 232 Investigations pertaining to a variety of US imports remain in process. An announcement of the related additional product‑specific duties is expected in the coming months and could result in a re‑escalation of global trade tensions, a possible development that should not be overlooked.

Tariff rate differentials possibly benefiting China-based suppliers’ US business

It should also be noted that tariff rate differentials have given certain countries comparative advantages when it comes to exporting to the US. In specific terms, Chinese Mainland exports to the US will be subject to a 20% tariff rate (10% reciprocal tariff + 10% Fentanyl related) from 10 November 2025 to 10 November 2026. This comparatively low additional tariff level puts Chinese Mainland‑based suppliers, on a par with many of their Southeast Asia counterparts and provides them with a significant competitive advantage over countries with a higher tariff rate, given China’s more mature and highly productive supply chains (See Table 4). Inevitably, this has spurred many global business leaders to reassess their longer‑term strategies when it comes to optimising their US and non‑US business portfolios.

Table 4: US Reciprocal Tariffs Against Selected Economies

Economy | Tariff rate |

ASEAN | |

Brunei | 25% |

Cambodia | 19% |

Indonesia | 19% |

Loas | 40% |

Malaysia | 19% |

Myanmar | 40% |

Philippines | 19% |

Singapore | 10% |

Thailand | 19% |

Timor-Leste | 10% |

Vietnam | 20% |

China* | 10% + (10%*) |

India | 25% + (25%#) |

Japan | 15% |

Mexico* | 0% + (25%*) |

South Korea | 15% |

Taiwan | 20% |

UAE | 10% |

* China and Mexico are also subject to Fentanyl tariffs. China is subject to an average traffic rate of ~20% before the current round of reciprocal tariffs, according to the Peterson Institute for International Economics | |

Sustained demand for AI-related electronics helping drive world trade growth

In terms of product mix, AI‑related products4 emerged as the central driver of world trade growth in 2025, with the sector’s positive momentum expected to be sustained throughout 2026. In terms of value, globally, the trade in AI‑related products expanded by more than 20% yoy in the first half of 2025, significantly outpacing the 6.0% yoy level of overall global merchandise trade growth, according to the WTO.

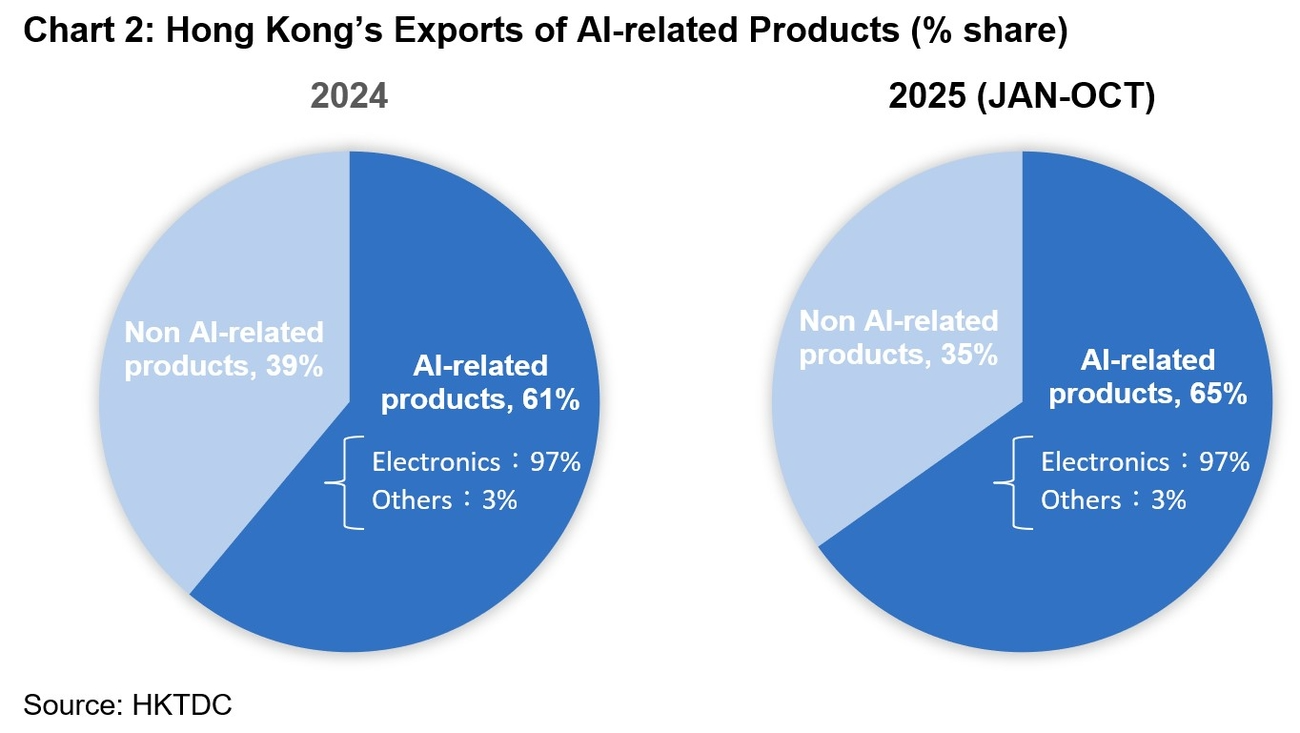

Hong Kong’s electronics sector, which accounts for more than 70% of Hong Kong’s total export value, in particular benefited from this AI‑driven trade in terms of the export of AI‑related electronic products, which surged by 22.0% yoy in the year through October (See Table 5). Considering the ongoing prioritisation of AI‑related digital transformation, demand for associated electronic products will, inevitably, be a decisive element in Hong Kong’s future export performance (See Chart 2).

Table 5: Hong Kong’s Exports of AI-related and Non-AI-Related Products

2024 | 2025 Jan-Oct | |||

HK$ mn | YoY Change | HK$ mn | YoY Change | |

AI-related products | 2,267,778 | 15.8% | 2,775,883 | 22.4% |

- Electronics | 2,205,233 | 15.8% | 2,690,145 | 22.0% |

- Others | 62,545 | 14.1% | 85,739 | 37.1% |

Non AI-related products | 1,474,289 | -0.7% | 1,484,307 | 0.7% |

- Electronics | 505,378 | -0.2% | 488,518 | -3.3% |

- Others | 968,911 | -1.0% | 995,790 | 2.8% |

Total exports | 3,742,067 | 8.7% | 4,260,191 | 13.8% |

Source: HKTDC (compiled in line with WTO definitions) | ||||

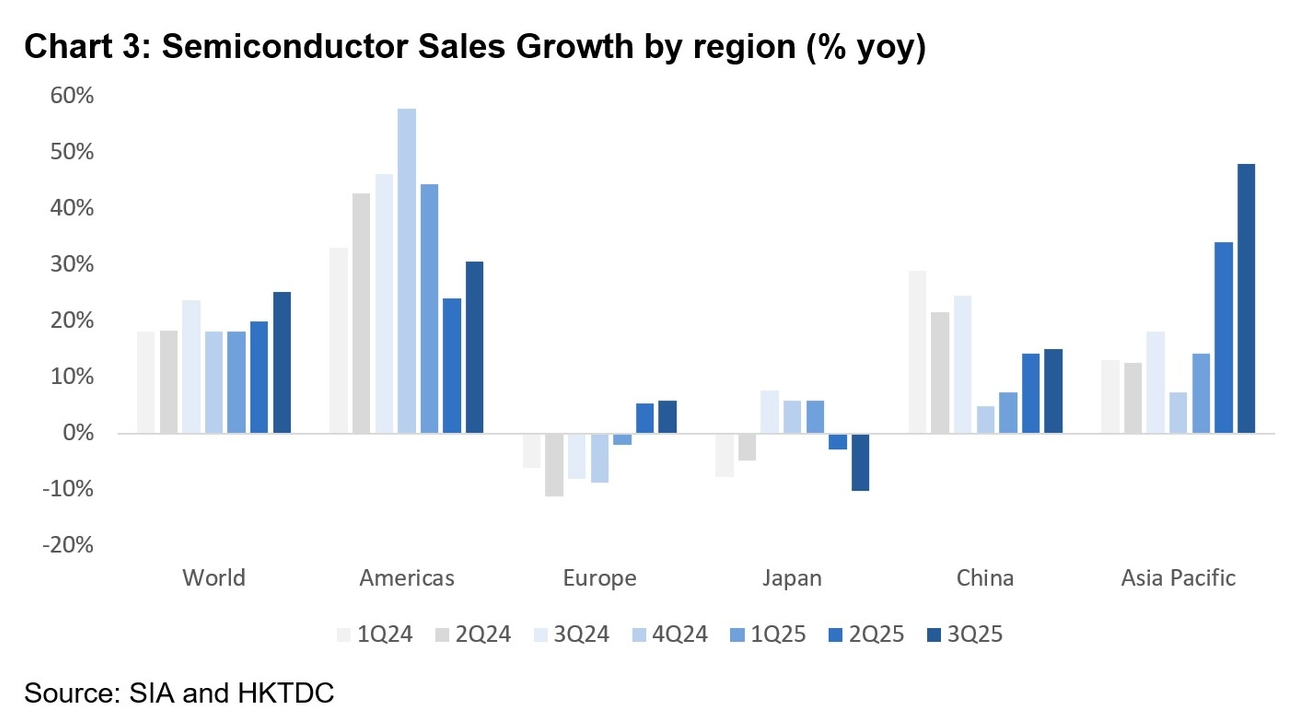

A key indicator of the likelihood of sustained demand for AI‑related electronic products, global sales of semiconductors increased by 25.1% yoy in 3Q 2025, well above the growth of 18.2% and 19.9% (respectively) recorded for the preceding two quarters, according to figures from the Semiconductor Industry Association (SIA) (see Chart 3). The SIA is currently predicting an even stronger performance in global semiconductor sales for 2026, with an annual growth of over 25%, following an estimated 22.9% increase for 20255, an outcome of clear benefit to Hong Kong electronics exporters.

According to the findings of the recently‑released HKTDC 4Q25 Export Confidence Index, the majority of exporters (53.2%) see rising demand for AI/new technology‑related electronic consumer goods as the factor most likely to boost their 2026 business.

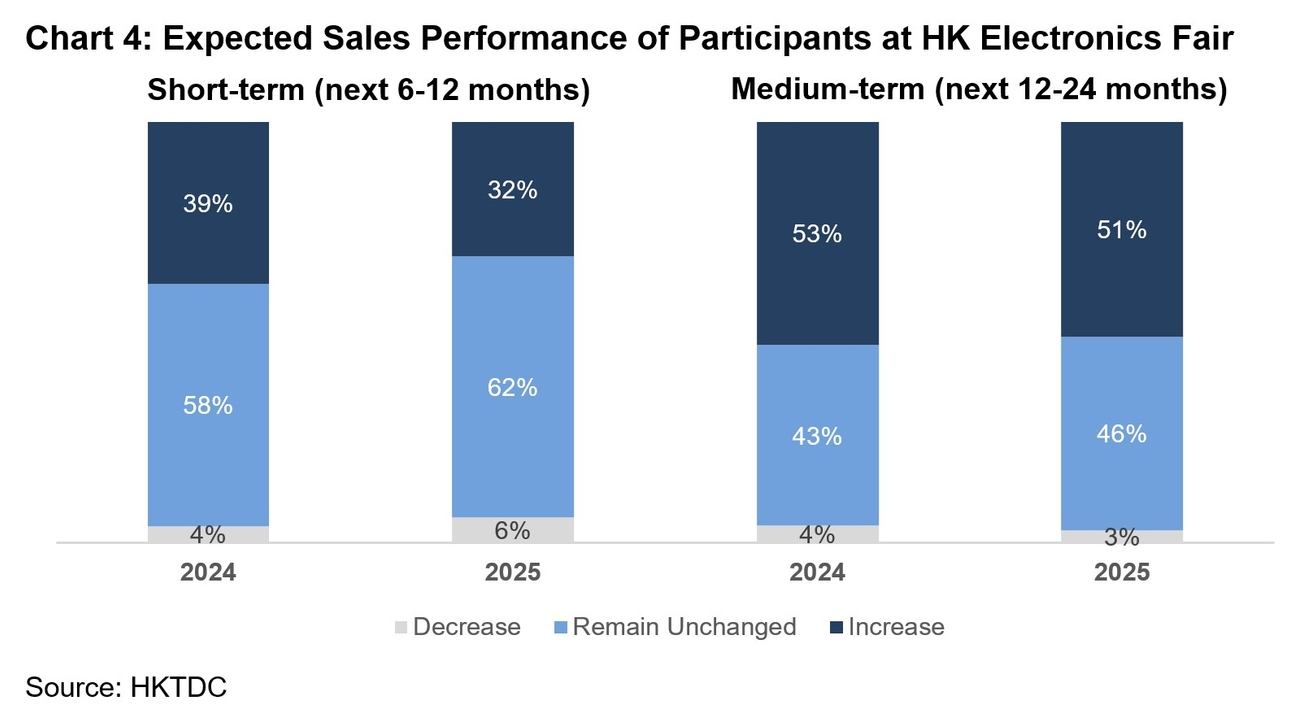

A further HKTDC survey, one conducted during the October 2025 Hong Kong Electronics Fair (Autumn Edition), also highlighted the likelihood of a sustained 2026 export performance for the sector. In all, this saw 51% and respondents expected their sales to increase and 46% expecting them to remain unchanged in next 12‑24 months (See Chart 4).

Strong growth for the year ahead

All things considered, HKTDC Research is optimistic with regard to Hong Kong’s 2026 export performance. In light of this, it is forecasting export growth of 8‑9% for the next 12 months, regardless of the high base comparison in 2025 (See Chart 5).

1 On top of Trump 1.0 tariffs. The average tariff rate is about 20%, according to the Peterson Institute for International Economics.

2 Global Trade Outlook and Statistics, WTO, October 2025.

3 The TPU index is compiled by the staff of the International Finance Division of the Federal Reserve Board and measures media attention to news related to trade policy uncertainties. The index is scaled, with ‘100’ indicating that 1% of news articles reference TPU.

4 This is based on about 100 AI‑related product lines, including semiconductors and processors, finished computers, servers and telecommunications equipment, according to the WTO. For details of the non‑exhaustive list of AI‑enabling products, please see Annex A.1. of World Trade Report 2025.

5 Global Semiconductor Sales Increase 4.7% Month‑to‑Month in October. SIA

First, please LoginComment After ~