MuniFin's first GBP benchmark of the year sets new oversubscription record for Nordic agencies

On Thursday, 8 January, MuniFin (Aa1 / AA+, both stable) skilfully navigated the crowded Sterling market and issued its first benchmark of the year. The bond captured investors’ attention, and the GBP 300 million deal was oversubscribed almost instantly – setting a record for Nordic agencies.

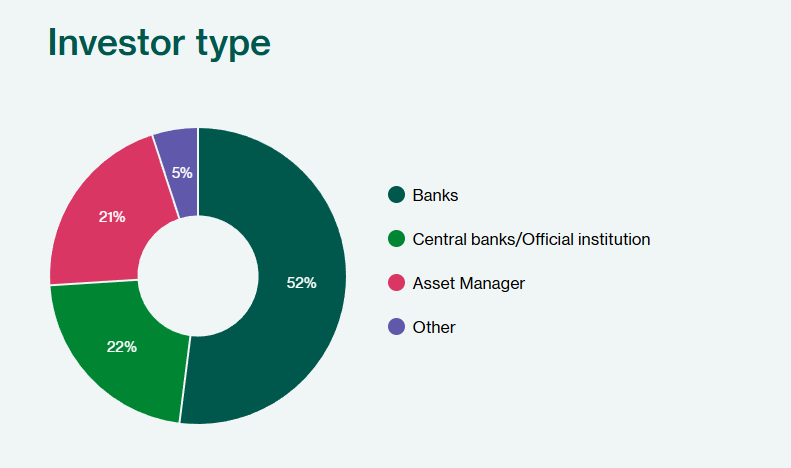

The successful bond was announced at 08:50 London time, with initial guidance of SONIA +45bps. Due to overwhelming investor interest, the books closed at 10:30 with a record demand in excess of GBP 1.1 billion, which is the largest ever for a Nordic agency.

The bond carries a 4% coupon and was finally priced at a spread of +44bps versus SONIA and 24.8bps versus the 0.375% UKT due October 2030.

”We knew that a significant amount of GBP notes were being redeemed toward the end of last year, leaving many investors with cash to deploy. Even so, the strong demand for MuniFin paper surpassed our expectations, making this an excellent start to the year.” says Manager Lari Toppinen from MuniFin’s funding team.

“MuniFin’s latest 4.5-year GBP 300 million transaction is surely a record in Sterling for MuniFin, underscoring their enduring strength and the investment community’s trust. This transaction once again proves MuniFin’s capacity to engage the market effectively and secure strong investor participation, and we are proud to have partnered with them on this issuance,” said Neal Ganatra, Head of SSA Syndicate from Deutsche Bank, which acted as a Joint Lead Manager on the issuance.

In 2026, MuniFin’s long-term funding target is EUR 9– 10 billion.

Transaction details

| Issue Amount | GBP 300 million |

| Issuer Rating | Aa1/AA+ (Moody’s / S&P) (all stable) |

| Pricing Date | 8 January 2026 |

| Settlement Date | 15 January 2026 |

| Maturity Date | 22 October 2030 |

| Price / Yield | 99.750 / 4.062% a / 4.022 sa |

| Reoffer Spread | SONIA mid-swap (A, A/365) + 44bps |

| Annual Coupon | 4.000% Fixed, Annual, short first |

| Listing | Nasdaq Helsinki Stock Exchange (Regulated market) |

| Documentation | MuniFin’s EMTN Programme |

| ISIN | XS3273035892 |

| Joint Lead Managers | Deutsche Bank / NatWest / Nomura |

Comments from Joint Lead Managers

“Congratulations to the MuniFin team for a spectacular first public print of 2026. The funding team expertly navigated a crowded pipeline and were rewarded with record orderbooks, record oversubscription, and to top it off, the pricing achieved was inside the issuer’s outstanding sterling curve. A stellar result and we are proud to have been involved at NatWest.”

Karen Manku, Director, SSA DCM, NatWest

“Congratulations to the MuniFin team on a fantastic return to the GBP market with a perfectly timed Oct-2030 benchmark. The commitment and consistency to this market has been rewarded with the largest ever orderbook for a MuniFin Sterling benchmark; testament to the team’s efforts on investor engagement and the strong credit appeal. Nomura was delighted to have supported them on this transaction.”

Sara Montes, Executive Director Public Sector DCM, Nomura

First, please LoginComment After ~