From Sandbox to Strategy: Hong Kong Charts Its Next Digital Asset Leap

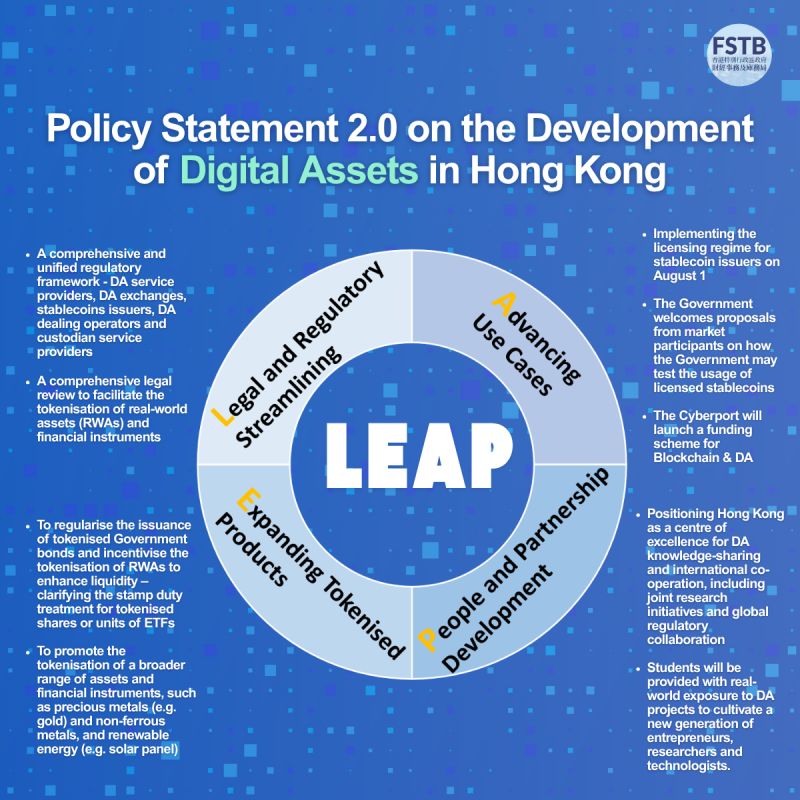

As global financial centres weigh the risks and rewards of digital assets, Hong Kong has made its position unmistakably clear: this is no longer an experiment. With the release of its Policy Statement 2.0 on the Development of Digital Assets, the city is sharpening its strategy—blending legal certainty with market dynamism—to anchor itself as a regulated, inclusive, and innovation-friendly digital asset (DA) hub.

For legal advisors structuring tokenised fund vehicles, fund managers eyeing digital bonds, or compliance officers evaluating stablecoin regimes—Hong Kong's latest roadmap is not just another policy announcement. It is an operational blueprint with concrete measures, regulatory commitments, and fiscal incentives designed to integrate digital assets directly into the real economy.

FSTB LinkedIn Post

FSTB LinkedIn Post

A Unified Regime: From Fragmentation to Clarity

One of the most notable updates: Hong Kong is introducing a comprehensive licensing regimecovering digital asset dealers and custodians. The Securities and Futures Commission (SFC)will take the lead for non-bank entities, while the Hong Kong Monetary Authority (HKMA)will oversee banks' DA activities.

This streamlining does more than reduce regulatory friction. It directly addresses industry concerns about jurisdictional arbitrage and fragmented oversight—particularly relevant for cross-border players seeking predictable compliance frameworks.

The government emphasizes a “same activity, same risks, same regulation” principle—critical for global firms seeking regulatory convergence.

Tokenised Bonds, Now a Permanent Fixture

After two successful green bond tokenisation pilots totaling HK$6.8 billion, Hong Kong is now regularising tokenised government bond issuance. Expect new variations in currency and tenor, expanded secondary market use cases, and integration of digital moneyfor settlement efficiency.

This transition from pilot to policy sends a clear message: tokenisation is no longer on trial—it is becoming infrastructure.

RWAs and Commodities: Tokenisation Finds Ground

Beyond financial instruments, Hong Kong is encouraging tokenisation of real-world assets (RWAs)—including warehouse-stored precious metals, energy assets, and even electric vehicle charging revenue streams.

With the London Metal Exchangeapproving Hong Kong as a delivery point, the city is positioning itself as a tokenised inventory nodewithin global commodity flows. For ESG-focused investors and global supply chain managers, this signals new possibilities for digitally traceable, fractionalised, and sustainable asset structures.

Hong Kong also clarifies that stamp duty exemptionsapply to tokenised ETFs, encouraging market participants to explore secondary trading on licensed DA platforms. A review of tax treatment for other authorised funds is also on the horizon.

Stablecoins: From Speculation to Settlement

Hong Kong's stablecoin framework, effective 1 August 2025, is designed for institutional-grade implementation. With clear rules on reserve management, stabilisation, and redemption, it aims to support use cases across cross-border trade, public payments, and capital markets.

In contrast to the regulatory ambiguity seen in other markets, Hong Kong’s approach signals a pragmatic pivot: enabling stablecoins that are safe, supervised, and settlement-ready.

Talent, Technology, Trust

Policy 2.0 goes beyond regulation. It lays out a broader ecosystem play:

Cyberportwill expand incubation support for DA and Web3 startups, including funding, mentorship, and accelerators.

InvestHKstands ready to assist foreign DA businesses with market entry and partnership formation.

The HKEX DA index seriesnow offers Asian time-zone benchmarks for Bitcoin and Ether, increasing transparency for institutional trading.

Meanwhile, Hong Kong universities will partner with global firms on joint R&D in tokenisation, blockchain, and AI-driven fintech, helping build a future-ready talent base.

Why It Matters

For stakeholders across finance, law, insurance, and trade, Hong Kong’s DA strategy offers three immediate takeaways:

Regulatory Coherence: A unified regime reduces uncertainty and raises the bar for compliance predictability.

Institutional Infrastructure: From tokenised bonds to stablecoins, the legal and operational rails are being laid.

Cross-Border Relevance: For firms with Asia-Pacific ambitions, Hong Kong offers a gateway built on both innovation and oversight.

As other markets debate policy in principle, Hong Kong is operationalising it. For professionals navigating the next phase of finance, this is a development not just to monitor—but to engage with.

📄

Full policy statement available here:

Policy Statement 2.0 on the Development of Digital Assets – HKSAR Government, June 26, 2025

First, please LoginComment After ~