Macao's Financial Pulse: Key Highlights from the Latest Data

In the fast-paced world of global finance, keeping a pulse on diverse markets is crucial. Macau SAR, with its unique economic landscape, offers intriguing insights for international business professionals. Here’s a concise yet comprehensive roundup of the latest financial data from Macao, focusing on mortgage loans and foreign exchange reserves.

Mortgage Market Dynamics

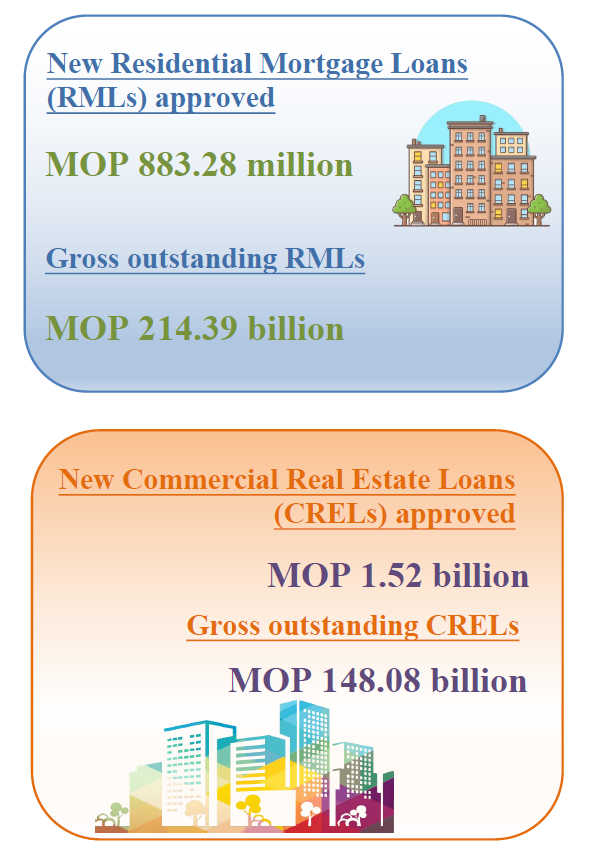

Residential Mortgage Loans (RMLs)

In April 2025, new RML approvals in Macao SAR increased by 13.8% month-on-month to MOP883.28 million.

The majority of these loans, 92.7%, were granted to residents, rising by 6.8% to MOP818.38 million.

Non-resident RMLs also saw a significant increase to MOP64.89 million.

However, the monthly average of new RMLs from February to April 2025 was down 15.7% compared to the January to March 2025 period.

Commercial Real Estate Loans (CRELs)

New CREL approvals decreased by 22.1% month-on-month to MOP1.52 billion in April 2025.

Resident CRELs, accounting for 66.9% of the total, fell sharply by 45.6% to MOP1.01 billion.

Non-resident CRELs increased to MOP500.84 million.

The monthly average of new CRELs from February to April 2025 edged up by 1.1% from the prior period.

Outstanding Balances and Delinquency Rates

The outstanding value of RMLs decreased by 0.6% month-on-month and 5.3% year-on-year to MOP214.39 billion as of end-April 2025.

The delinquency ratio for RMLs stood at 3.6%, stable from the previous month but up 0.1 percentage point from a year earlier.

For CRELs, the outstanding value was MOP148.08 billion, down 0.3% from the previous month and 5.2% from a year ago.

The delinquency ratio for CRELs was 5.5%, a 0.1 percentage point increase from the prior month and a 2.1 percentage point rise from end-April 2024.

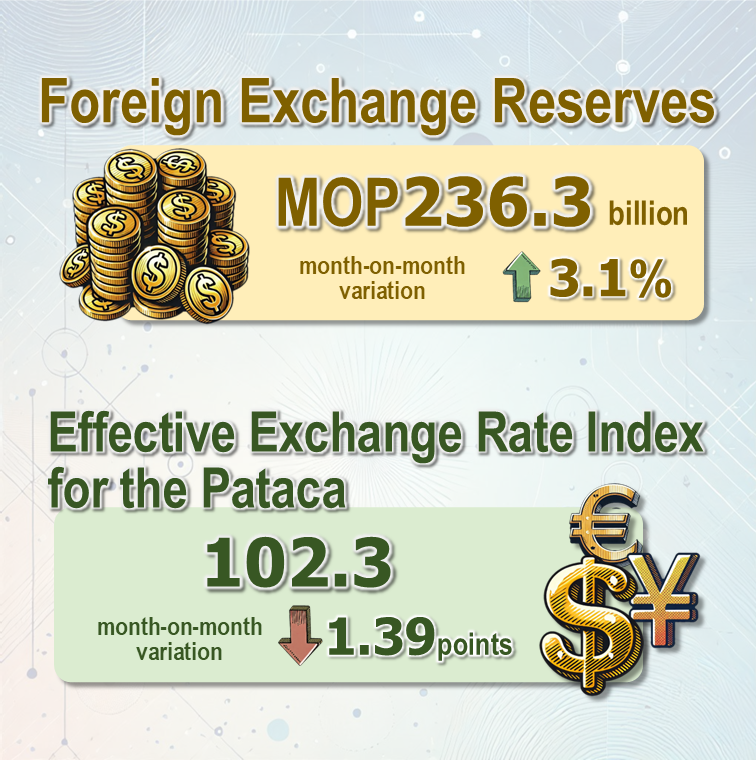

Foreign Exchange Reserves and Effective Exchange Rate

Macau SAR’s foreign exchange reserves were preliminarily estimated at MOP236.3 billion (USD29.26 billion) at the end of May 2025, a 3.1% increase from the previous month’s revised value.

The reserves equated to 11 times the currency in circulation or 89.9% of pataca M2 at end-April 2025.

The trade-weighted effective exchange rate index for the pataca dropped by 1.39 points month-on-month and 2.89 points year-on-year to 102.3 in May 2025.

These key highlights from Macao’s financial data provide a snapshot of the region’s economic health. For international business professionals, especially those with interests in Macao SAR, monitoring these indicators can offer valuable insights into market trends and potential opportunities or challenges. Whether you’re in banking, investment, corporate management, or related fields, staying informed about Macao’s financial landscape can enhance your decision-making and strategic planning.

First, please LoginComment After ~