Japanese Highlights of the Outlook for Economic Activity and Prices (April 2025)

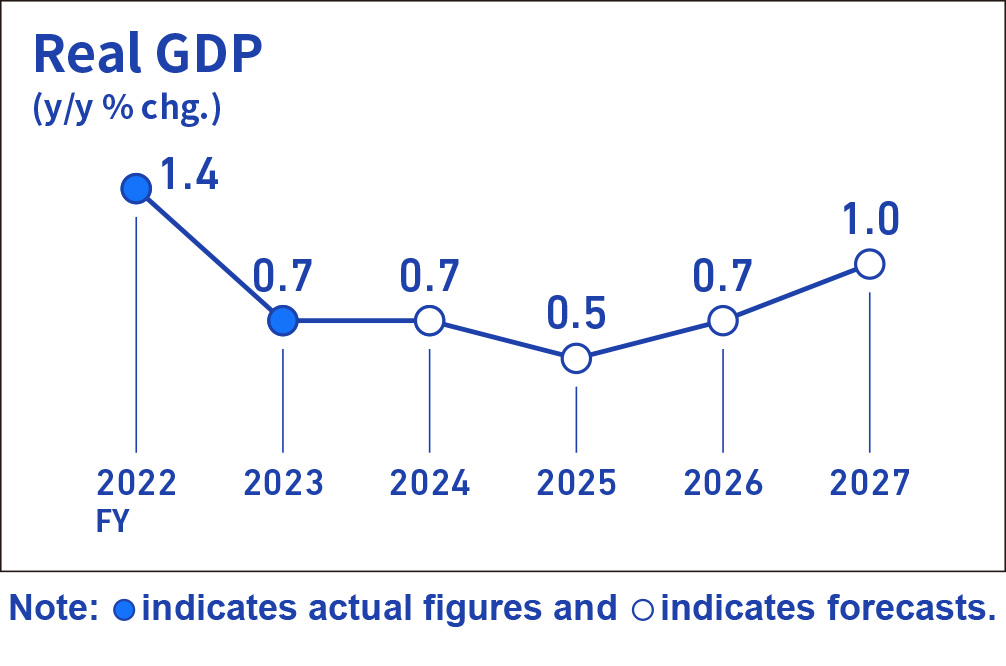

Japan's economic growth is likely to moderate.

Japan's economic growth is likely to moderate, as trade and other policies in each jurisdiction lead to a slowdown in overseas economies. Thereafter, Japan's economic growth rate is likely to rise, along with growth in overseas economies.

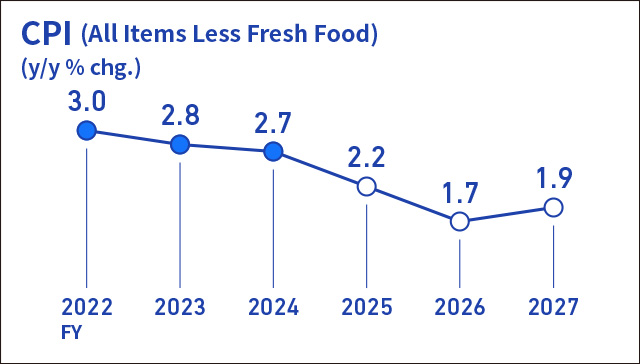

Inflation is likely to decelerate and then move toward around 2 percent.

The year-on-year rate of increase in the CPI is likely to decelerate to the range of 1.5-2.0 percent for fiscal 2026, due to the waning effects of price rises, mainly in food, and the deceleration in the economy; the rate is then likely to be at around 2 percent for fiscal 2027.

The course and impact of trade and other policies are extremely uncertain.

It is extremely uncertain how trade and other policies in each jurisdiction will evolve and how overseas economic activity and prices will react to them. In addition, it is necessary to pay due attention to the impact of these developments on financial and foreign exchange markets and on Japan's economic activity and prices.

The Bank will conduct monetary policy with the 2 percent target.

As for the conduct of monetary policy, if its outlook for economic activity and prices will be realized, the Bank, in accordance with improvement in economic activity and prices, will continue to raise the policy interest rate and adjust the degree of monetary accommodation. In this regard, it is important for the Bank to carefully examine and judge whether the outlook will be realized, without any preconceptions.

Policy Board Members' Forecasts

Outlook for Economic Activity and Prices

For further details, please see "The Bank's View" and the full text of the Outlook for Economic Activity and Prices (Outlook Report) on the following pages:

First, please LoginComment After ~