Private Investment Awakens as China’s Fixed-Asset Momentum Rises

China's fixed-asset investment (FAI) climbed 4.2% year-on-year in the first quarter of 2025, reaching RMB 10.32 trillion (approximately USD 1.43 trillion), according to data released Wednesday by the National Bureau of Statistics (NBS). This marks a notable acceleration from 2024's full-year rate of 3.2% and signals a cautious yet deliberate pivot toward industrial and private sector revitalization—despite continued drag from real estate.

For global investors and multinationals monitoring China's domestic pulse as a barometer for regional capital flows and industrial demand, the first quarter figures offer a layered picture: one of selective recovery, with strength concentrated in manufacturing, high-tech, and infrastructure.

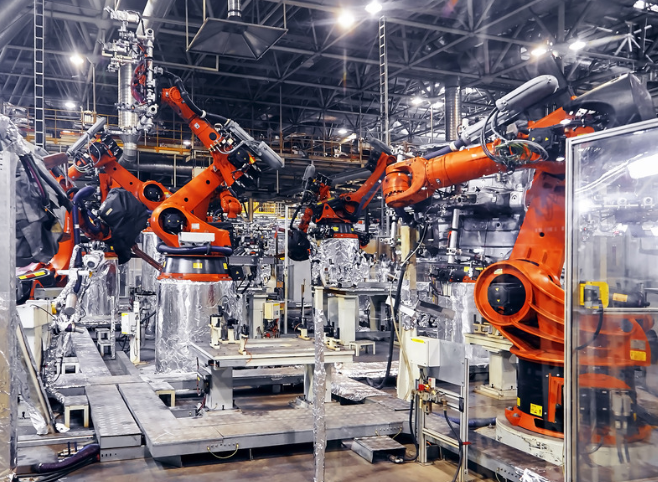

Manufacturing and High-Tech Investment Lead the Charge

Among the standout performers, manufacturing investment surged 9.1% year-on-year, underscoring Beijing's continued prioritization of industrial upgrading in response to geopolitical pressures and supply chain reconfiguration. Particularly striking was the 30.3% jump in investment in aerospace vehicle and equipment manufacturing, alongside a 28.5% increase in computer and office device manufacturing. These figures align with China's broader push to strengthen tech self-sufficiency under the “new productive forces” narrative that has dominated policy discourse in early 2025.

This signals concrete demand for foreign capital, talent, and IP that can complement China's ambitions in advanced manufacturing—especially from ASEAN and Europe-based suppliers in components, precision engineering, and dual-use technologies.

Private Sector Signals a Tentative Comeback

Perhaps the most quietly significant shift lies in the modest 0.4% year-on-year increase in fixed-asset investment from China's private sector, reversing a full-year decline in 2024. While the number may appear small, it is symbolically weighty, reflecting early signs of renewed confidence after a prolonged capital winter.

Sheng Laiyun, deputy head of the NBS, attributed the turnaround to a “raft of government policies aimed at improving the business environment.” These include measures unveiled by the National Development and Reform Commission (NDRC) in February, which focus on enabling private firms to participate in major national projects, upgrade industrial equipment, and access incentives in consumer markets.

The timing is critical. Foreign investors—particularly those in financial services, asset management, and export credit—have been seeking signals of re-engagement from China's domestic private economy, which traditionally accounts for over 50% of fixed asset formation and nearly 80% of urban employment.

If this uptick gains traction, it may offer new momentum for joint ventures, minority equity participation, and RMB-denominated funding structures targeting domestic infrastructure and industrial parks.

Property Pain Persists—but Urbanization Offers a Long-Term Rationale

Unsurprisingly, property development investment continued its slump, falling 9.9% year-on-year as the sector remains in a prolonged deleveraging phase. However, Sheng emphasized that “growth potential remains,” citing ongoing urbanization and demand for “green, spacious and comfortable” housing.

For foreign developers and insurers involved in mortgage-backed securities, construction financing, or climate-aligned real estate funds, the implication is twofold: near-term risk management remains essential, but medium-term opportunities tied to urban renewal and ESG-aligned assets remain credible.

Northeast China's Unexpected Role as a Growth Engine

Interestingly, China's northeastern rust belt—comprising Heilongjiang, Jilin, and Liaoning—posted the fastest regional FAI growth at 9.7%, reflecting Beijing's efforts to rejuvenate aging industrial regions through central investment and talent retention policies.

This shift could open strategic opportunities for logistics firms, environmental service providers, and professional consultancies looking to establish early footholds in these lesser-saturated but policy-backed regions.

ASEAN Integration Strengthens: RMB Transactions Surge in Cambodia and Malaysia

Complementing China's domestic investment story is the notable rise in cross-border RMB transactions with Cambodia and Malaysia. According to the People's Bank of China, Q1 RMB trade settlements with Cambodia soared 45% year-on-year to RMB 5 billion, while those with Malaysia reached RMB 102 billion—up 27%.

These trends underscore China's ambition to internationalize the renminbi while deepening financial and supply chain integration with ASEAN economies. The PBOC pledged continued support to simplify RMB usage in cross-border trade and investment, signaling a policy continuity that benefits banks, fintech firms, and trade service providers with RMB infrastructure.

For firms active in trade finance or treasury services across Southeast Asia, this creates clear incentives to enhance RMB capabilities—not just as a compliance measure, but as a differentiator in customer service and liquidity access.

Strategic Takeaways for Global Institutions

·Investors and Trade Banks: Watch for targeted joint ventures in manufacturing zones and logistics hubs where private sector activity is being revived with policy backing.

·Asset Managers: ESG and infrastructure-focused funds could find near-term allocation opportunities in the northeast and high-tech sectors.

·Corporate Treasury Teams: Enhanced RMB settlement infrastructure in ASEAN—especially in Malaysia and Cambodia—justifies strengthening cross-border RMB liquidity management tools.

·Legal and Accounting Firms: The policy shift toward empowering private firms opens demand for deal structuring, compliance, and due diligence services tailored to non-SOE clients.

First, please LoginComment After ~